January is when most business owners consider direction for the year ahead. Goals and priorities are reviewed and agreed, projects and work begins to be mapped out. For the farming sector, this is valuable time before seasonal peak workloads arrive in the form of lambing, calving and spring arable duties. For many rural businesses, 2026 also needs to be the year diversification moves from “we should do something” to a structured programme with clear decisions and a delivery plan.

Why 2026 feels more urgent than ever

Several developments since Q4 2025 reinforce why early action matters this year:

- Profitability remains uncertain, and the lack of scheme clarity is amplifying risk. Baroness Batters’ Farming Profitability Review, published in December 2025, highlights sustained cost pressure and notes that some farmers, particularly in the arable sector, are questioning viability. It also references an Office for Budget Responsibility forecast that input costs will be 30% higher in 2026 than in 2020, and points to policy uncertainty as a material concern, including around the Sustainable Farming Incentive.

This challenge is compounded by limited forward visibility on the environmental support landscape. At the CLA Rural Business Conference in November 2025, the Environment Secretary acknowledged mistakes earlier in the year and set out the intention to reform SFI, stating that full scheme details, including budget, timings and eligibility, will be published well ahead of launch.

The minister has since announced, at the Oxford Farming Conference, that the reformed Sustainable Farming Incentive will be reopened for smaller farms and those who aren’t within an active agreement in June 2026, with larger farms available to apply from September 2026. The reformed SFI is likely to have fewer options, limits on scale and a potential agreement value cap, according to the minister. This is welcomed clarity on the future of environmental payment support for farms and should afford landowners greater confidence that environmental income will remain part of the cash flow mix (subject to no U turns or delays…), it also reinforces why 2026 is the year to progress diversification decisions on what you can control: business strategy, project feasibility, planning strategies, and deliverability.

- Planning policy is shifting, and that makes early 2026 the best window to lock in a deliverable route to consent. The Government launched a major consultation on proposed reforms to the National Planning Policy Framework on 16 December 2025, running until 10 March 2026. For farms and estates, the practical issue is not the politics of planning reform, it is that local planning decisions and negotiation positions tend to tighten once a new national direction is set. The consultation also puts emphasis on themes that regularly affect rural projects, including onsite energy generation and a more standardised approach to viability inputs, which can influence how schemes are justified and conditioned. Our view is that waiting for perfect certainty is usually a false economy. If you act now, you can sense-check policy fit, select the right consent route, and build the evidence base early. That protects optionality, reduces redesign risk, and keeps your programme moving while others are still waiting for clarity.

- Inheritance tax policy has moved again, and April 2026 creates a hard milestone for estate decision-making and project sequencing. The Government announced on 23 December 2025 that the allowance for 100% Agricultural Property Relief and Business Property Relief will increase from £1 million to £2.5 million per spouse when introduced on 6 April 2026, and this was reinforced in a Treasury written statement on 5 January 2026. This is significant, but it should not be read as a reason to pause. The DPA view is that it is a reason to get organised. Diversification can change the nature of activity on an estate, the way assets are held, and the timing of investment decisions. Acting early in 2026 gives families the time to align governance, ownership structures and professional advice with a sensible project pipeline, so delivery decisions support the long-term plan rather than creating unintended complexity later.

Against this backdrop, hesitation, whilst understandable, has a hidden cost.

What our Diversification Report 2025 tells us

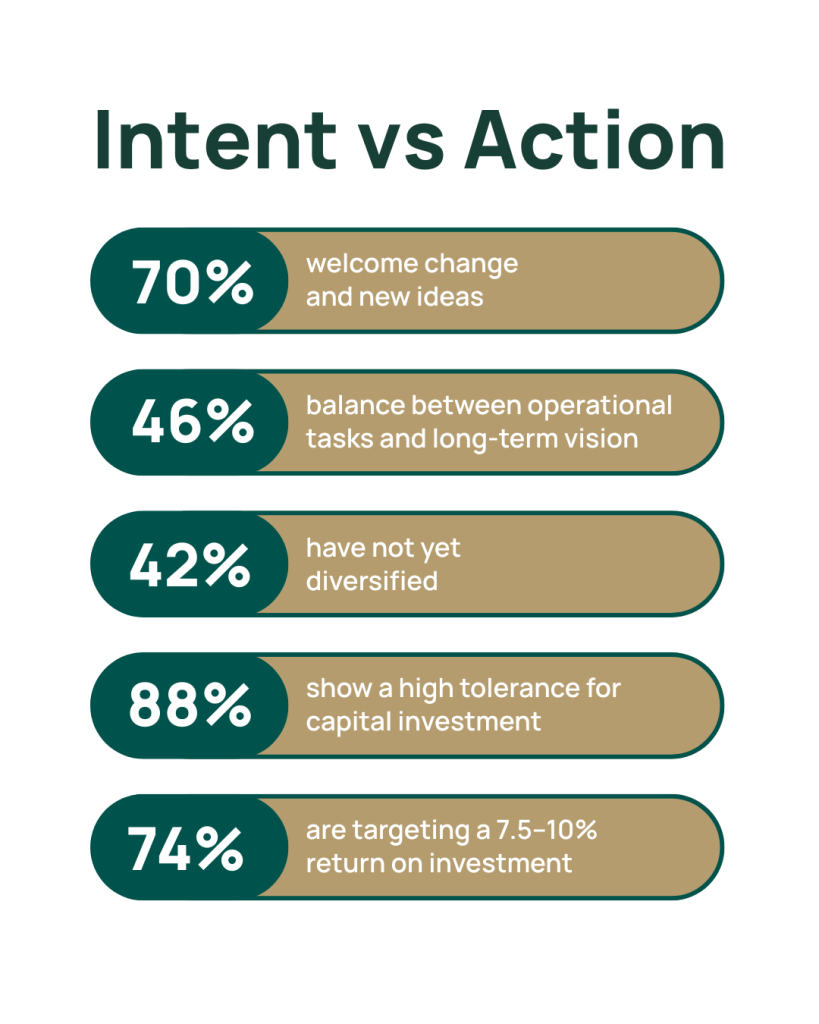

Our Farm Diversification Insights Report 2025, built from responses to our Diversification Planner, shows that indecision is rarely about a lack of ambition:

- 70% of landowners and farmers welcome change and new ideas

- 46% maintain a balanced focus between immediate operational tasks and long-term vision

- 42% of respondents have not yet diversified, despite recognising potential benefits

- 88% demonstrate a high tolerance for capital investment, yet many remain hesitant to commit

- 74% are targeting a 7.5–10% return on investment, suggesting clear and grounded financial ambition

The insight is simple. Most landowners are not resistant to investment in projects and diversification. Many are practical, delivery-minded operators who sit in the middle ground. They see the need for change, but they are balancing operational pressure with genuine uncertainty about risk, planning and the “right” opportunity to pursue first.

Why diversification decisions stall on UK farms and estates

From our rural project management and diversification experience, there are four recurring blockers.

1. No clear estate-wide direction

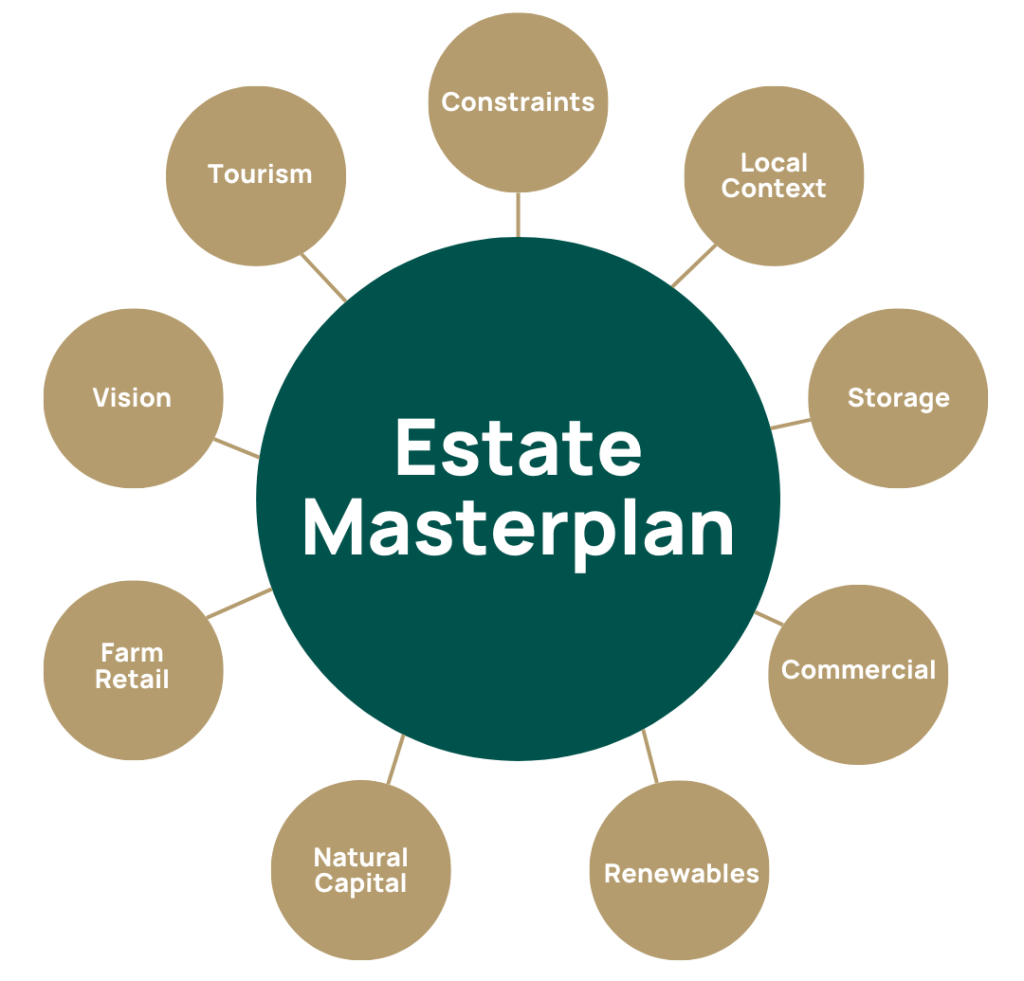

Without an holistic masterplan, diversification ideas compete and dilute focus rather than align. Building conversion, commercial units, tourism, renewables, farm retail, storage and farming can all look viable or unviable in isolation. The difficulty is choosing the right sequence and proving what is deliverable.

2. Policy and planning uncertainty

When national policy is shifting, delay feels safer. The mid-December planning consultation in England is a good example of why early appraisal matters. Even if policy emphasis changes, your project still needs a robust planning pathway, sound justification and a clear understanding of constraints from the start. The reality is, NPPF reform is unlikely to significantly reduce the requirements and consents required to progress a project through planning.

3. Stakeholder complexity

Many farms and estates have multiple decision-makers: multigenerational family members, trustees, shareholders, tenants and business partners. If priorities are not aligned, progress and innovation stagnates. A clear governance process and structured decision points are often more important than the initial idea itself.

4. Operational pressure always wins

Modern farming businesses typically have to run lean. Seasonal peak workloads, compliance, staffing and day to day operations will always take priority if diversification is treated as a “spare time” or “fringe” project. The practical solution is to treat diversification as a formal programme with staged outputs and a realistic timeline. The impact of additional revenue within the business can be transformational with regard to profitability and risk, as the Farm Profitabiliy Review demonstrates.

The risk of doing nothing in 2026

Inaction is not neutral. Delays can reduce flexibility, future opportunities and increase cost. Redundant buildings deteriorate, funding windows and priorities shift, finance costs increase, planning policy fluctuates and decision fatigue grows. The longer a project sits in limbo, the harder it becomes to deliver quickly when the business eventually can’t survive without the additional income.

At the same time, some signals are positive. The RPA payment update in December is one example of the focus on improving delivery and cash flow into the sector. It also reinforces the importance of building a more resilient income mix that is not wholly dependent on these conventional support mechanisms.

Turning hesitation into confident action

The farms and estates we work with that move forward successfully are rarely the ones who rush, nor stall. They are the ones who structure decisions properly.

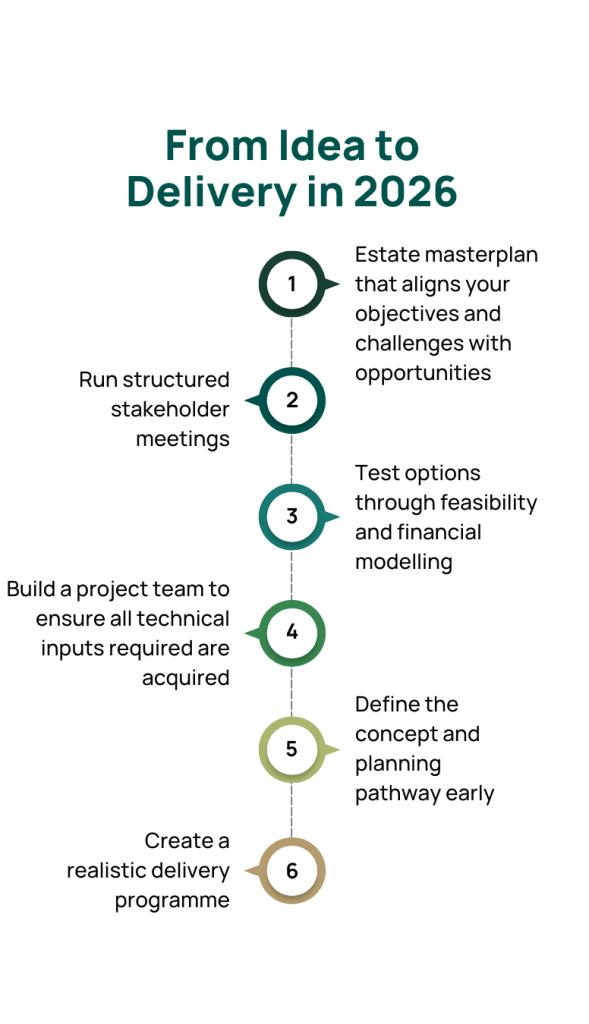

A practical route that we can help with looks like this:

- Start with an estate masterplan that aligns your objectives and challenges with opportunities, whilst considering constraints, existing operations, succession, planning policy, local context, markets, demographics, mobility and so on

- Run structured stakeholder meetings, with agreed criteria for selecting and prioritising projects

- Test options through feasibility and financial modelling, including realistic capex, phasing, planning risk, operating cost and risk mitigation

- Build a project team to ensure all technical inputs required are acquired, preventing future unexpected costs and dealys

- Define the concept and planning pathway early, including what can be achieved through permitted development and what requires a full planning strategy, to reduce risk of abortive costs

- Create a realistic delivery programme, with clearly identified responsible project team members, procurement routes, cost and compliance control mechanisms

This is where professional rural project management adds outsized value. Not by selling “big ideas”, but by converting ambition into decisions, and decisions into built outcomes.

Make January 2026 the moment you commit to progress

If diversification has been on the list for years, the New Year is the best time to reset. The first quarter is often the ideal window to begin the journey.

Dudley Peverill Associates supports UK farms and estates with rural projects and diversification, from concept to completion. If you want clarity on the best next step for your rural business, we can help you turn uncertainty into a structured route forward.