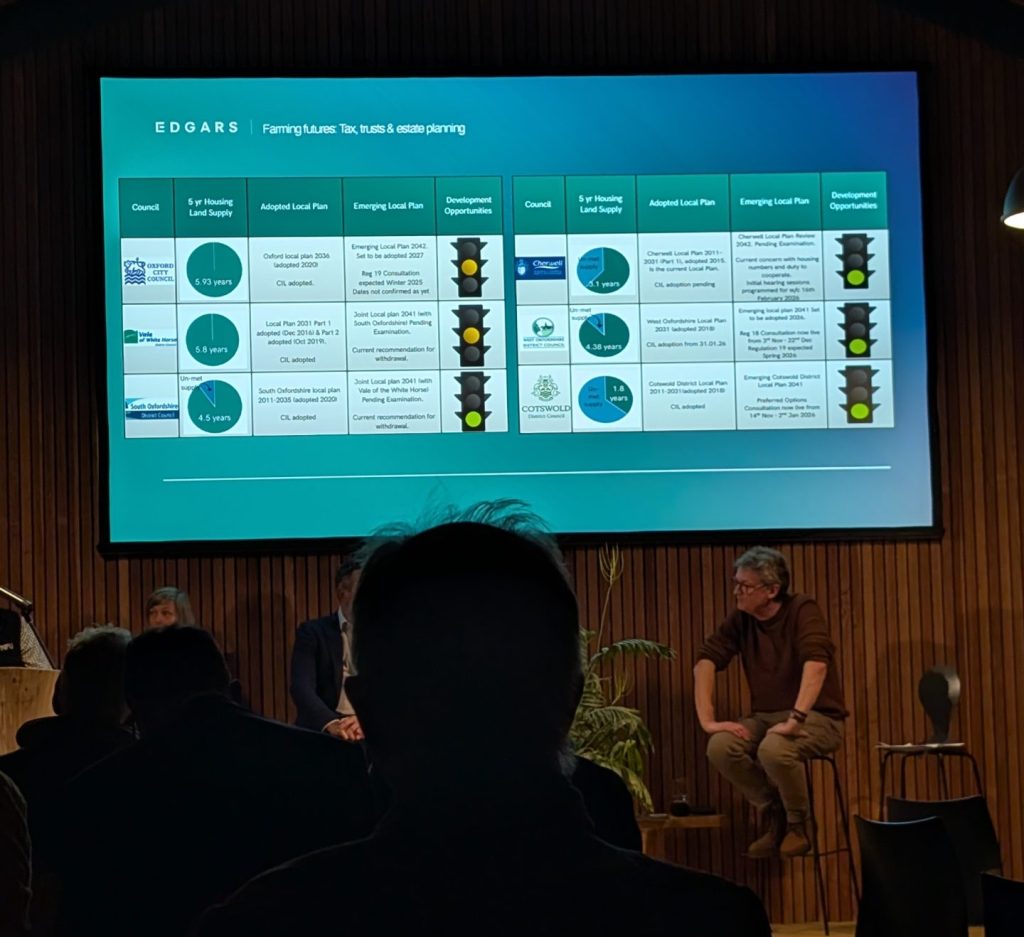

Jon Westerman recently highlighted some big changes in the planning world: more staff, ring-fenced funds, and the ability to charge for applications, all aimed at speeding up approvals. For landowners, this creates a friendly planning environment and opportunities like Class Q conversions, even in green belt areas (though not national landscapes).

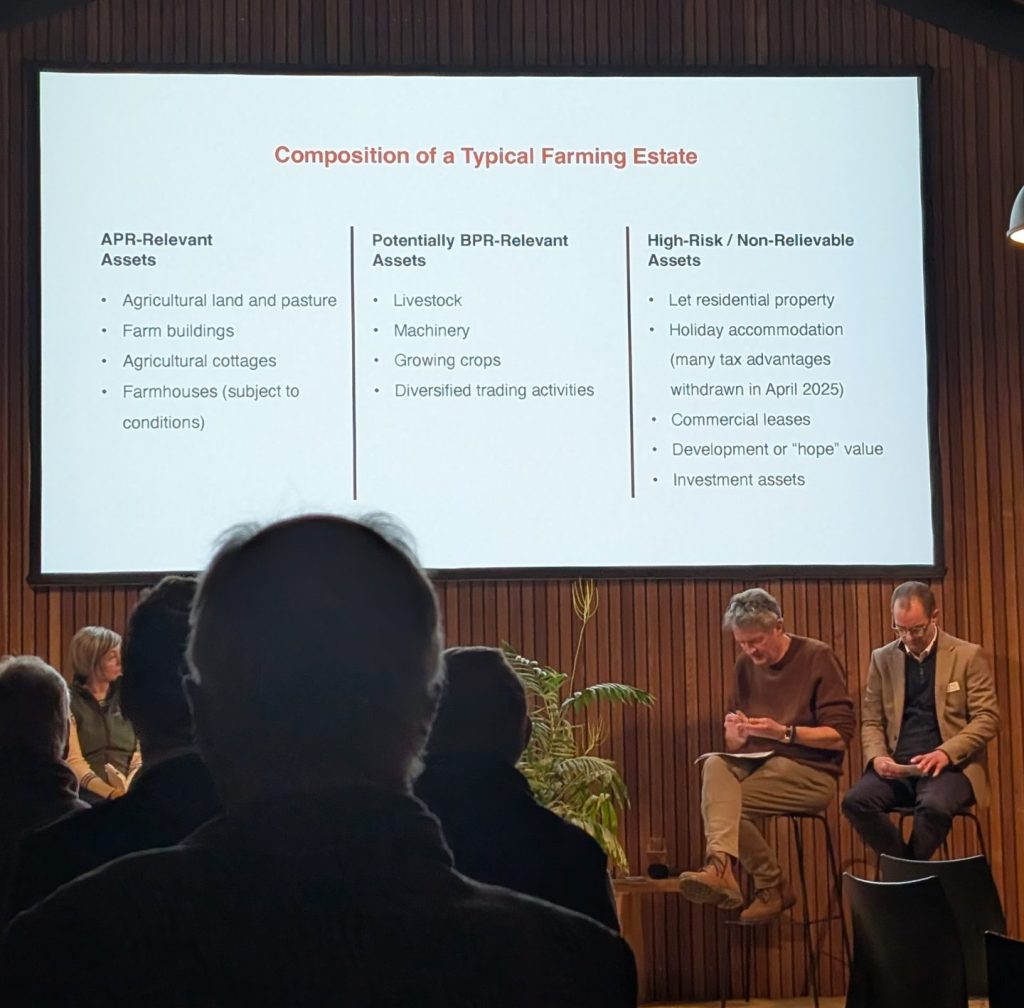

Sounds exciting, right? But here’s the reality: once you secure planning permission, your property value can jump significantly. That uplift, the “delta” between agricultural value and development (or hope) value, is taxable. Gary McHale reminded us that this is where many landowners get caught out. Opening a farm shop or diversifying can also trigger a shift from Agricultural Property Relief (APR) to Business Property Relief (BPR).

And HMRC? They’re increasingly scrutinising partnership agreements to ensure ownership and control align with what’s on paper.

So before you rush to develop, think about timing and tax strategy.

There were comments about waiting for a change of government to repeal recent IHT changes, but realistically, that could take 6–7 years. In practice, that’s almost the same timeframe as using a PET (Potentially Exempt Transfer) gift allowance now and letting it run its course. In other words, delaying action might not give you the advantage you expect, planning early could be far more effective.

Succession matters too.

A Family Charter isn’t just a document, it’s a governance framework that protects the values and principles of the senior generation, ensuring they’re respected and appropriately remunerated, while empowering the next generation to drive the business forward. Combine this with robust structures like Family Investment Companies (FICs), and you create a model that reflects your family’s ethos and withstands HMRC scrutiny.

Final Thoughts

Planning permission can unlock huge opportunities, but also big tax implications. Get advice early, protect your legacy, and make informed decisions.

Have you considered how planning permission could impact your tax position and succession plans?

Get in touch with Dudley Peverill to discuss your planning permissions.